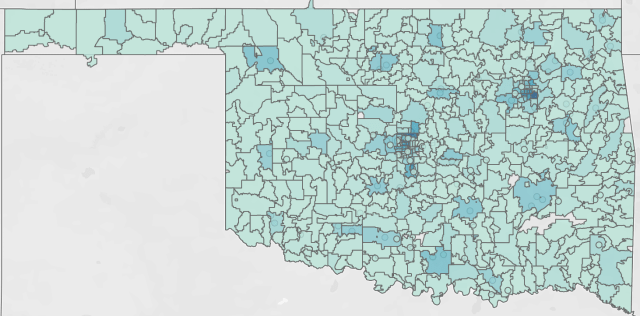

Heat map of amounts of federal Payroll Protection Program given to Oklahoma businesses by ZIP Code. CLIFTON ADCOCK/The Frontier

Thousands of Oklahoma companies that received federal assistance to retain workers during the COVID-19 pandemic reported retaining no jobs, others laid workers off after receiving the assistance, and suburban areas got outsized amounts of federal assistance, according to an analysis of Payroll Protection Program data by The Frontier.

Facing lawsuits by media organizations and advocacy groups, the U.S. Small Business Administration last week made the PPP loan data public. But they did so only for companies that received more than $150,000 in loans and they only provided amount ranges for the loans, rather than specific amounts.

In total, 64,278 Oklahoma businesses and organizations received between $4.2 billion and $7.8 billion in federal Payroll Protection Program funds between April 3 and June 30, according to the SBA data. The data states that more than 620,000 jobs in Oklahoma were retained as a result of the program’s federal relief funds.

An initial look at the data showed two of Oklahoma’s congressmen, Rep. Markwayne Mullin, R-Westville, and Rep. Kevin Hern, R-Tulsa, had businesses that received millions of dollars in PPP funds. Oklahoma churches received nearly $154 million in taxpayer-funded PPP loans, and 44 Oklahoma companies were in the highest band of PPP recipients nationwide by being approved for loans of between $5 million and $10 million.

A deeper look at the data shows that some of those companies receiving loans that were intended to keep workers in their jobs have since laid workers off, and that suburban communities often received outsized total loan amounts. And thousands of companies received loans without guaranteeing the money would go toward retaining jobs.

And perhaps unsurprisingly considering Oklahoma reliance on energy, the industry that received the most in PPP funds was support services for oil and gas operations.

The Payroll Protection Program (PPP) was one part of the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act passed by Congress and signed by President Donald Trump in late March. The idea behind PPP was to provide small businesses with funds to pay up to eight weeks of payroll costs including benefits, though some of the funds can also be used to pay interest on mortgages, rent, and utilities.

Under the program, a small business can apply for funds through a participating bank or other lending institution. If the business retains or quickly rehires its existing employees and keeps its payroll level, the loan is eventually forgiven. The program is also open to nonprofit organizations and faith-based nonprofits such as churches. The deadline to file for PPP has been extended to Aug. 8, as $130 billion of the $660 allocated to the program remains in the fund.

Top recipients

Using North American Industry Classification System codes included in the loan data — including the loans of less than $150,000 — the industry that received the most PPP funds overall was support services for oil and natural gas. In total, those businesses received up to $301.5 million in PPP funds and reported 14,154 jobs retained, followed by full-service restaurants, which received up to $278.6 million with a reported 42,394 jobs retained, according to the data.

The top recipients for oil and gas support operations were Oklahoma City-based BOFS Management, which got $5mm to $10mm with 494 jobs retained and Legend Energy Services LLC in Oklahoma City, which also got up to $10 million in PPP and reported 229 jobs retained. Both loans were issued in early April.

Other oil and gas-related operations were also in the top 20 Oklahoma industries receiving PPP funds, including crude petroleum extraction (No. 17, up to $79.7 million), oil and gas field machinery and equipment manufacturing (No. 18, up to $74.6 million) and drilling oil and natural gas wells (No. 20, up to $69.3 million).

Doctors’ offices, new car dealers and attorneys’ offices rounded out the top five Oklahoma industries receiving PPP, according to the data.

Religious organizations in Oklahoma were also one of the top 10 industries receiving government PPP funds, according to the data, landing at No. 7 on the top recipients of PPP. They reported receiving up to $153.9 million in funds and retaining a reported 18,432 jobs, according to the data.

In addition to being one of the last major municipalities to require businesses to close to try and prevent the spread of COVID-19 and one of the first to reopen in late April, Broken Arrow also had one of the highest concentrations of federal PPP funds received by businesses based there.

According to the data, the Oklahoma zip code that received the most in PPP funds was Broken Arrow’s 74012. Businesses listing that zip code received a combined $206.4 million. That ZIP Code also had the fourth highest number of coronavirus cases in the state with 404, the Oklahoma State Department of Health reported Tuesday.

The ZIP code with the next highest amount received in PPP funds was 73013, an Edmond ZIP code, that received around $182.4 million.

Among Broken Arrow recipients, two companies — McDaniel Technical Services and AG Equipment Company — were in the top tier of loan recipients, those who received between $5 million and $10 million in PPP funds, and reported 250 jobs retained.

Other prominent PPP recipients in that zip code included Mullin Plumbing, Mullin Environmental and Mullin Services, all three of which are owned by Congressman Markwayne Mullin.

Eight Broken Arrow companies all reporting the same Broken Arrow address also received a combined $6.4 million in PPP funds and reported 931 jobs retained. “Switchgrass Management” limited liability companies and two “Quality Brand Management” companies, all owned by Broken Arrow resident Richard Verity, received four loans of up to $350,000, three loans of up to $1 million, and one loan of up to $2 million. The Switchgrass companies manage up to 28 Burger King franchises while the Quality Brand Management companies operate Taco Bueno restaurants. Verity did not respond to requests for comment from The Frontier.

The PPP loans were supposed to go to small businesses — defined by the SBA has having fewer than 500 employees — though early on, several larger companies were able to receive funds. An exception was also carved out for hotel and restaurant franchises in the Coronavirus Aid, Relief and Economic Security (CARES) Act, which authorized the PPP. U.S. Rep. Kevin Hern, R-Tulsa, who made his fortune owning several McDonald’s franchises, along with other Congressmen wrote a letter to Senator leadership crafting the CARES Act urging them to increase the loan size available to franchises to four times a franchise’s monthly operating expense.

Hern’s company, KTAK Corporation received a PPP loan of up to $2 million for a reported 220 jobs retained, and was among the first companies to be approved for a PPP loan on April 5. Hern, who voted against an earlier coronavirus relief bill, the Families First Coronavirus Response Act, which required some employers to provide paid sick leave for workers who got sick from COVID 19 or had a family member sick with the virus, later voted in favor of the CARES Act.

Both Hern and Mullin later voted against legislation that would have required the PPP loan recipients to be made public and required the SBA to disclose its decision-making process in disbursing the loans.

However, according to the data, the industry in the 74012 Broken Arrow ZIP Code that was the top overall recipient of PPP funds was religious organizations, which received more than $13 million combined in taxpayer-funded loans across 30 churches and retaining a reported 1,032 jobs.

At the same time, a total of 36 full-service restaurants in Broken Arrow also received PPP funds, 34 Broken Arrow beauty salons and the same number of nail salons, but the total amounts were far lower than the amounts provided to churches — full-service restaurants were only provided up to $5.3 million in PPP, beauty salons got up to $7.8 million, while nail salons got up to $2.4 million.

The Roman Catholic Diocese of Tulsa was the top Broken Arrow-based religious organization recipient, with a loan of up to $5 million, followed by Rhema Bible Church and the Church at Battle Creek, both of which got loans of up to $2 million, and followed by the First Baptist Church of Broken Arrow and Immanuel Ministry and Education Association, both of which got loans of up to $1 million, according to the data.

Other recipients

Some companies that received PPP funds to save jobs ended up laying off workers anyway.

Hitch Enterprises in Guymon, which operates a large cattle ranch as well as pork production, feed lots and crop production, received up to $5 million in PPP funds to retain 288 jobs on April 8, according to the PPP data. However, by late June, the company announced it would be laying off more than 150 employees at its Guymon farms.

Jason Hitch, chairman and CEO of Hitch Enterprises, said he was unsure whether the anticipated layoffs, which he said would likely occur through the fall and into winter, would cause the company to have to repay the PPP loan.

“We don’t know. We’ve made the application, we’ll see,” Hitch said. “It (the layoffs) is not like turning out the lights. It’s not a one-time thing It will occur over many months.”

A&B Distributors, a bottling company which has locations in Muskogee and Oklahoma City, also received up to $2 million in PPP funds, approved in early April, and reported a total of 150 jobs retained. However, the company has since reported it will be laying off around 160 people at its locations.

Skirvin Partners, which operate Oklahoma City’s historic Skirvin Hotel, received up to $2 million in PPP funds, approved April 9, to retain 158 jobs. However, in its notice to the Oklahoma Department of Commerce, the hotel stated it reopened on June 22 but that the financial cost of the pandemic was too much and that it would be laying off 80 employees beginning July 31.

Oklahoma City’s Lyric Theatre also received up to $350,000 in PPP funds on April 5, with a reported 26 employees retained, but announced on May 26 that it would be laying off 15 employees.

Of the 64,278 Oklahoma businesses that received PPP money, 1,723 companies reported receiving a total of $136.9 million funds but with zero jobs retained, according to the data. Another 1,785 businesses, which received a total of $238.9 million in PPP funds, did not report how many jobs would be retained by receiving the funds.

The top PPP recipients that reported zero jobs retained were the Oklahoma City federally qualified health center Variety Care and Tulsa road construction company Becco Contractors, both of which received loans of up to $10 million.

The top PPP recipient that left the space for “jobs retained” blank, was Tulsa’s Latshaw Drilling, which got up to $10 million in PPP. Numerous other companies received between $2 million and $5 million while not reporting the number of jobs retained by the funds, such as the Quapaw Tribe’s Downstream Development Authority (which operates its casino), Mach Resources in Oklahoma City and Tulsa’s WTI Holdings.

Fifty casinos and casino hotels received between $33 million and $75.6 million in PPP funds, reporting more than 5,665 jobs retained.

The largest casino and casino hotel recipients were the Osage Nation Gaming Enterprise ($5 million to $10 million), the Comanche Nation — which received two loans of up to $5 million for its casino and hotel — the Quapaw Tribe’s Downstream Development Authority, the First Council Casino in Perry and the Kiowa Casino Operations Authority, all of which got between $2 million and $5 million in PPP.

To view the entire Oklahoma PPP dataset, click here.